Forex traders come up with different strategies to make successful trades, but one of the most important aspects of successful trading is the ability to predict future price movements based on current market momentum. To achieve this, different technical indicators are used to conduct an analysis of the market; moving averages is one of such indicators.

Moving averages are indicators that determine the trend direction of a currency pair by using the average closing prices of an asset over a specific period of time. This technical indicator is popular among traders because it filters out market noise and points out the future price movement of a currency pair which aids trading decisions.

In forex, there are 2 main moving averages used for trading, and they are Simple and Exponential Moving Averages.

What is the Simple Moving Average (SMA)?

The SMA or Simple Moving Average is a common indicator used in all financial markets, including forex. It predicts the direction of a trend by considering the average closing prices of a currency pair over a specific time frame. For example, a 20-day simple moving average will calculate the closing prices of an asset over 20 days and divide the total by 20 to get the moving average. When a new closing price is added, the previous one is removed from the average.

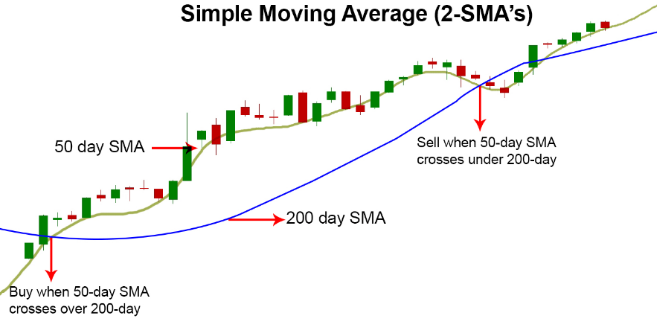

This indicator typically uses longer time periods like 50 or 200 days, and for accuracy, it can be used in conjunction with another SMA with a different time period to confirm any change in price behavior. Since SMA is simple to use and popular among forex traders, it is often used to form support or resistance lines, and traders base their decisions depending on the trend that shows.

Pros and Cons of the Simple Moving Average

Pros

- Simplicity: One of the benefits of SMA and also the main difference between simple and exponential moving averages in forex is its simplicity. Traders can quickly determine both the current and future price trends from the direction of the SMA. For instance, the simple moving average will trend higher when the price of a currency pair increases, and when the prices fall, the SMA will trend downward.

- Does not respond to temporary price changes: The SMA is not prone to the volatility of the stock market as it does not respond to temporary price changes or 'market noise' as it is called.

- Helps in identifying support and resistance levels: Using SMA as one of your indicators reduces the need to form a support or resistance line on your chart because it already acts like one. For instance, if the SMA line is below the price and the price rises and falls without going below the line, that area can be identified as a potential support level. However, if the price falls below the simple moving average and continues to rise and fall below the SMA line, that can also be identified as a resistance level.

Cons

Despite its advantages, the SMA as a technical indicator does have its setbacks. It is a lagging indicator which means that it doesn't adjust quickly to the volatility of the forex market. However, it is important to note that the short-term SMA responds faster to price changes than the long-term SMA. Although SMA is mostly used by traders trading on longer time frames, it can be adjusted to show trends in shorter time periods, but the disadvantage to this is that not enough price information will be included, which can affect trading decisions.

What is the Exponential Moving Average (EMA)?

The Exponential Moving Average (EMA) is another indicator popular among traders. The EMA pays more attention to recent price data in order to reduce the effects of price volatility and give a better picture of the trend direction of an asset. It is often used along with other technical analysis tools like RSI and MACD.

When trading, most traders tend to use two forms of EMA- a long-term EMA and a short-term EMA. For this EMA trading strategy, the trader would buy orders when the short-term EMA rises above the long-term EMA (golden-cross signal), and they will sell the currency pairs when the short-term EMA goes below the long-term EMA (death cross signal).

The exponential moving averages can also be used as crossovers. For this strategy, the trader will typically use a single EMA to observe the price movement and make their decisions based on it. For instance, if the price of a currency pair remains above the EMA chosen by the trader, the trader will continue to buy that asset, but when the price falls below the line, there is a high chance for the trader to sell unless there is an immediate reversal in price movement.

Pros and Cons of Exponential Moving Average

Pros

- Accurate information on trend direction: Since it reacts faster to price changes, EMA can provide more accurate information on trend direction, and through EMA overlay, traders can determine the entry and exit points of a trade depending on where the price sits on the EMA line.

- Places priority on recent prices: Unlike the SMA, the EMA does not place weight on all price changes as it places more priority on recent price action.

For instance, if a 5-day EMA is used on a chart and there was an unexpected drop or rise in the price of the currency pair on Day 1 or Day 2, this price change will have a lesser impact on the results of the moving average compared to if the change had happened on more recent days like Day 4 or Day 5.

- Helps with forming support and resistance lines: Like SMA, EMA can also help in discovering support and resistance levels in a chart when 2 EMAs are used for crossovers.

Cons

The major setback when using EMA comes from its focus on more recent price changes because it is more susceptible to incorrect signals or temporary price changes. This is why it is always best to use this tool along with other technical analysis tools to get an accurate analysis on price movements.

Comparing SMA with EMA

Although it seems like there is a world of difference between the two, they share more similarities than differences. For one, they are both moving averages used for determining trend direction and forming support and resistance levels on a chart. Their differences majorly come into play depending on the trader's strategy and preference.

For short-term traders who want to make big profits, the exponential moving average is the best indicator to use because it places priority on recent price changes and it notices new trends quickly. Plus, it has more reliability and relevance for short-term traders. However, it has to be used as a confirmation of the existence of a trend rather than a primary technical indicator because it is prone to whipsawing and false signals. For instance, a stop-loss order can be placed when making a trade based on EMA to prevent losses caused by false signals.

For long-term traders, SMA may be a better technical indicator because it pays attention to past prices and it considers all price changes equally. Its slower reaction to recent price changes helps it smooth price actions allowing traders to understand the current price movement and determine future trends.

For spotting entry and exit points of trade, EMA is the better choice, and for forming support and resistance lines on a chart, SMA is usually the preferred technical indicator because of its long-term use. Although most trading platforms already have the formulas for these indicators embedded in their program, the simple moving average is easier to learn compared to the exponential moving average.

If you are not sure about which moving average to use, you can always combine the two to get an idea of the bigger picture. Also, depending on your strategy, you can switch between SMA and EMA to see which of these MAs will provide you with better results and improve your overall strategy.

Conclusion

Moving Averages are good indicators for technical analysis, and they can be used to come up with simple trading strategies to take advantage of opportunities. Also, SMA and EMA are popular among traders because they help to recognize current price patterns and trends and predict future price movements.

Since both moving averages have their probes and cons, the best thing to do is to test each one with your strategy and other chosen tools for technical analysis and see how it works for you. For you to get the best results from these moving averages, it is important to choose the proper length or time period because this can affect the relevance and reliability of the moving average- the proper length depends on what is best for your trading timeframe.