China has issued a stern warning to Japan over potential new restrictions on semiconductor equipment sales. The conflict centers around Japan's recent decision to tighten controls on exports of 23 types of chipmaking machinery, a move that aligns with broader Western efforts to curb China's access to advanced technology.

According to Bloomberg News, Chinese officials have communicated to their Japanese counterparts that severe economic retaliation could follow if Japan proceeds with further curbs on chipmaking tools. The warning comes amidst a backdrop of escalating global tensions surrounding semiconductor technology and trade policies.

China's Foreign Ministry has voiced strong opposition to what it describes as "artificial disruptions" of global production and supply chains. Mao Ning, a spokesperson for the Ministry, emphasized that China is committed to maintaining global trade stability and opposes any attempts to politicize economic cooperation. "China has always implemented fair, reasonable, and non-discriminatory export control measures," Mao said during a recent press briefing.

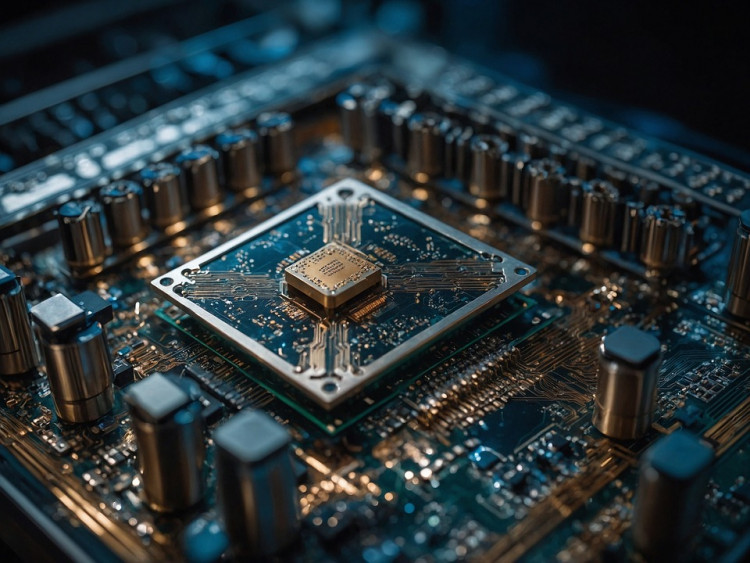

The dispute highlights the strategic importance of semiconductor technology, which underpins many modern industries, from automotive manufacturing to advanced computing. Japan's restrictions, effective since July, target a range of equipment essential for semiconductor production, including machines for depositing films on silicon wafers and systems for creating intricate circuit patterns.

Toyota Motor Corp., a significant player in Japan's industrial landscape, has reportedly conveyed concerns to Japanese officials regarding potential retaliatory measures from China. Bloomberg's sources indicate that Toyota fears Beijing might restrict Japan's access to crucial minerals needed for automotive production. This concern underscores the interconnected nature of global supply chains and the potential impact of trade conflicts on key industries.

Japan's chip policy aligns with broader Western strategies aimed at limiting China's technological advancement. The United States, along with its allies including the Netherlands, Germany, and South Korea, has been pushing for tighter controls on China's access to advanced semiconductor technology. The U.S. government has employed various tools, including the Foreign Direct Product Rule (FDPR), to regulate the export of American technology used in semiconductor manufacturing.

Despite ongoing negotiations, the U.S. has not ruled out the use of FDPR, which would allow Washington to control sales of products that incorporate American technology, regardless of where they are produced. This has sparked concerns among allied nations about the potential for such measures to strain diplomatic relations and disrupt global trade.

The Netherlands-based chip equipment maker ASML, a key player in the semiconductor industry, is facing its own challenges as the Dutch government considers further restrictions on its operations in China. ASML's dominance in manufacturing advanced semiconductor machines makes it a focal point in the broader trade dispute.

In recent developments, U.S. officials have been discussing additional restrictions on China's access to memory chips used in artificial intelligence (AI) and other advanced applications. This is part of a broader strategy to limit China's technological capabilities and maintain a competitive edge in critical technologies.

China's warning to Japan is part of a larger pattern of geopolitical maneuvering surrounding semiconductor technology. The industry's strategic importance has made it a central battleground in the ongoing trade tensions between major global economies. As Japan and China navigate their economic relationship, the potential for further disruptions in the global supply chain looms large.