Gold futures scored a fourth consecutive rally on Tuesday, drawing strength from doubts regarding the current global economy's decline as well as suspension of commercial activity aimed at curbing the coronavirus' spread.

Some U.S. currency weakness also gave a boost to bullion, even as shares, which tend to shift in the reverse path to safe haven commodities, climbed.

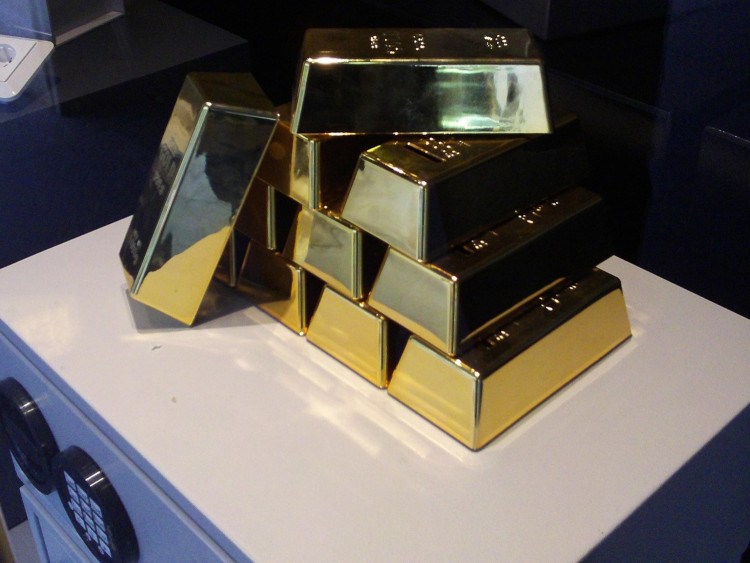

The yellow metal extended last week's ascent that saw the price of precious metals hit their peak in over seven years. Gold's new run is spurred on by cash injections to alleviate the pandemic's negative effects on the global economy.

Governments around the world are signing off on major stimulus initiatives in addition to near-zero levels and quantitative easing in hopes of business start-ups.

Futures in New York pushed nearer the $1,800 per ounce level, the last point seen in 2011. Spreads remain broad between futures and spot prices, indicating thinner liquidity, which further exacerbates price distortions.

For 2020, gold surged as the global health crisis tipped economies into a widespread turmoil and encouraged central banks to introduce major bailouts. Gold has been staging a rebound after last month's rally of forced selling as equities sunk.

Spot gold increased 0.3 percent at $1,694.50 an ounce, having earlier notched its highest mark since March 9 at $1,697.75. US gold futures were down 0.65 percent to $1,742.91.

The rise in gold came amid an increase in global equities after Chinese trade data came in better than anticipated and some countries sought to revive their economies by partially removing sanctions to contain the crisis.

Bullion has also jumped in conjunction with the weak financial markets this year, with recent sharp sell-offs causing investors to unload precious metals elsewhere to offset their losses.

Saxo Bank analyst Ole Hansen said enough safe-haven demand is still in place for gold to cushion any more weakness in stocks heading into company earnings season.

Gold for June delivery on Comex climbed by $7.50, or 0.4 percent, to settle at $1,768.90 per ounce after reaching $1,788.80 intraday high. According to Dow Jones Market Information, settlement and average on Tuesday were the highest prices for a most-active contract since October 2012.

Ryan Giannotto, GraniteShares research analyst, who provides the US: BAR GraniteShares Gold Trust, said the key factor at work in the gold market is the US central bank's enhanced lending and asset buying strategy unveiled last week.

Evercore ISI's Ed Hyman explained that as many as 285 stimulus efforts have been rolled out around the globe in the last eight months, the largest ever by a wide margin.