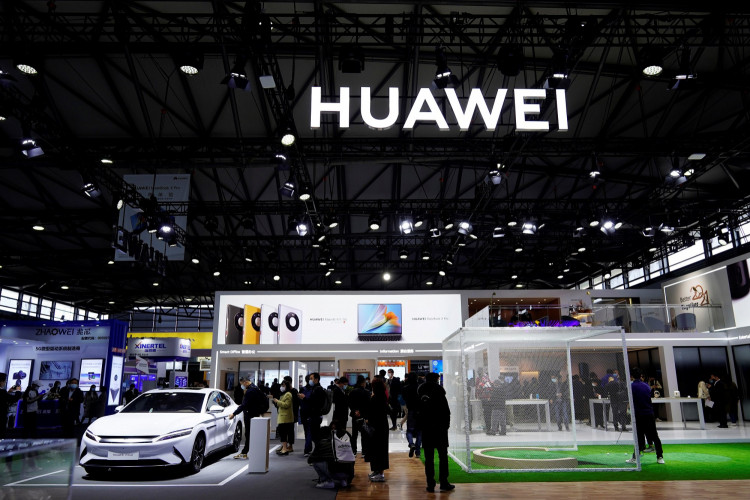

As China's tech giant Huawei faces a shrinking market value and tough revenue growth, it's doubling down on its automotive business with an ambitious plan to open around 800 HarmonyOS Smart Car stores by 2024. These stores, focusing on integrated sales, delivery, and after-sales services, mark a significant expansion in Huawei's footprint in the automotive industry.

A franchise recruitment document cited by 36Kr reveals Huawei's comprehensive strategy to partner with experienced luxury automotive sales and repair partners across 78 cities nationwide. An individual from Huawei's Terminal BG confirmed this expansion, stating that HarmonyOS Smart Car is the most comprehensive, close, and in-depth cooperation model between Huawei and car manufacturers.

Models from collaborations with Seres, Chery, JAC, and BAIC, such as the available AITO M7 and M5, will be sold under the HarmonyOS Smart Car name for marketing convenience. However, Seres-led AITO user centers will continue to focus exclusively on AITO.

Huawei's plan to establish these independent stores arises from the need for larger display spaces as the range of HarmonyOS Smart Car models expands. The future outlets will introduce higher-priced luxury models, necessitating service capabilities matching these high-end offerings. A salesperson associated with HarmonyOS Smart Car mentioned the necessity for stores with service capabilities that align with the premium nature of upcoming models.

Huawei's car sales channels are broadly categorized into three types: self-operated flagship stores, smart living halls or authorized experience stores (gradually transitioning to self-operated), and HarmonyOS Smart Car authorized user centers, which are the independent stores Huawei plans to establish. The majority are smart living halls or authorized experience stores. However, these often lack the space to display more than two cars, necessitating the move to larger, independent stores.

The expansion also comes with challenges. The newly launched M5, for instance, is reportedly facing slow arrival rates in stores. A salesperson cited slow shipments from the manufacturer, possibly related to the speed at which dealers make payments, as a contributing factor. Car industry expert Sun Shaojun noted that the M5's display and test drive car arrival rate was less than 30%, impacting customer choices and commitments.

As Huawei transitions its existing stores to direct-operated ones, the role of mobile phone dealers is diminishing. They are no longer responsible for management and sales but bear the store's rent instead. The starting capital for a HarmonyOS Smart Car authorized user center is around 20 million yuan, which may not be feasible for current mobile phone dealers due to the necessary capital and after-sales service capabilities.

Despite the ongoing challenges in revenue growth and profitability, Huawei's ambitious plan reflects its continued commitment to diversifying and expanding its business into the automotive sector. As it navigates the competitive market, Huawei's journey is closely watched by industry experts and consumers alike, with many eager to see how the company adapts and thrives in this new venture.