Investors have grown wary about the global economy's ability to recover faster from the declines caused by the pandemic. These investors have been eyeing how they could exit from the market before growth halts. Their ability to withdraw their investments, however, would greatly depend on how fast governmental lockdowns could reverse.

According to the Financial Times, major economies have observed both national and local lockdowns throughout the word. Most economic forecasts suggested that the yearly rate of decline of global gross domestic product (GGDP) during the first quarter of 2020 could reach 20 percent, triple the worst quarter experienced during the Great Recession in 2009.

Federal Reserve officials have also adapted to the US economy's incapacity to avoid an economic recession. Weekly activity estimates by the New York Fed showed significant drops in GDP more rapid than that of the 2008-2009 global economic crisis.

US forecasts generated by Goldman Sachs also manifested that the recession would start by the second quarter of 2020 where GDP would reach 11 to 12 percent below the pre-pandemic values. The report claimed that this would result in a dramatic decline with a yearly rate of 34 percent in the second quarter. However, it was perceived that the GDP would eventually but gradually rise before the end of 2021.

According to the US analysts, the pattern implied two years of economic troubles in the country that is also common with other jurisdictions' economic forecasts. It was even expected in European countries that are currently experiencing economic collapses in manufacturing output higher than that incurred during the 2012 euro crisis. Nevertheless, the economists claimed that the regions could experience partial recovery after China's economy has been improving last month.

In China, monthly annualized growth rates recovered by 4.6 percent in March compared to a negative 2.0 yield in February. However, China's exports remain partially stagnant as foreign markets continued to decline significantly.

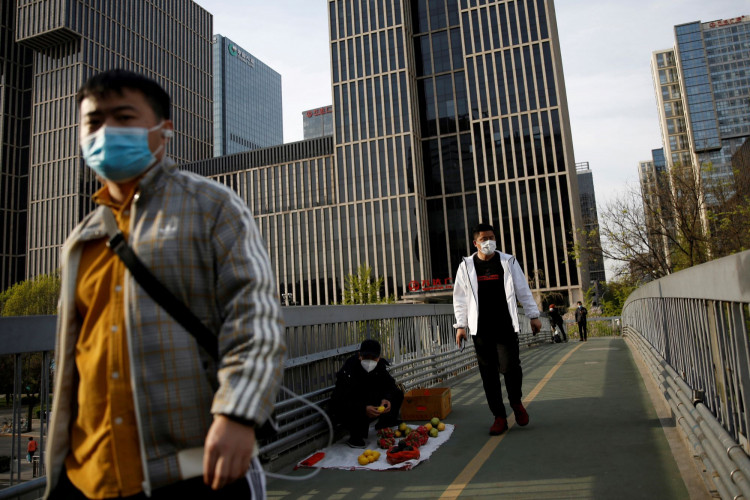

Meanwhile, industrial output growth still yielded a negative value since 2019 as the Chinese State Council prepares for measures that would promote economic growth in the second quarter of 2020. Beijing also imposed partial lockdowns in several major cities in the past week. According to economic forecasters, a strong global recovery might be achieved by the third quarter of 2020.

It was then perceived that the pattern in mainland China and Hong Kong during the SARS crisis in 2003 might be like the economic recovery rate that the country may experience post-pandemic including the recoveries during the Mers, Ebola, and swine flu crises. It was then suggested that a prolonged path to economic normalization may last for a few quarters backed by fiscal and monetary support for private corporate activities and political resistance.