Shares in Apple supplier Luxshare Precision Industry fell sharply this week after a patent infringement investigation against the company that was filed in the U.S. late last year came to light.

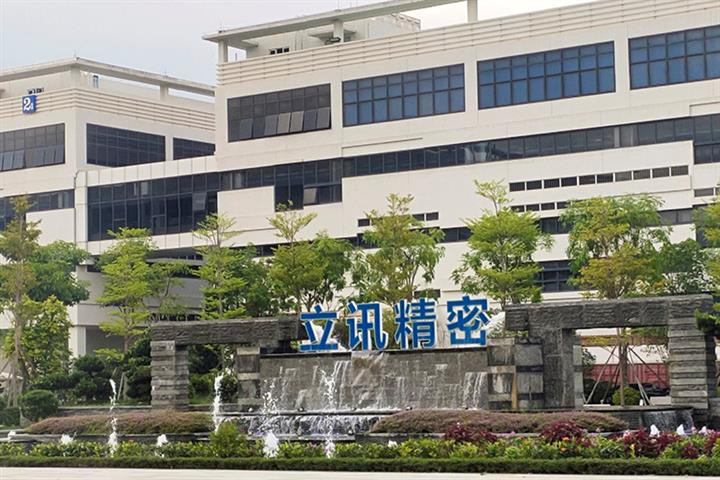

This Dongguan-based Chinese electronics manufacturer, which is poised to become the first mainland China-headquartered company to assemble iPhones, is seen as a challenger to Taiwan-based Foxconn that has long been Apple's biggest supplier.

On Monday, shares fell as much as 9.5% closing at 55.21 yuan ($8.53) per share.

Connecticut-based Amphenol on Dec. 18 filed a section 337 complaint against Luxshare Precision and its subsidiaries for infringing the patent rights on certain electrical connectors and shells, their components and downstream products.

Five U.S. patents involved in the investigation, including conductive plastic technology and terminal horizontal injection molding technology, were independently developed and designed by Amphenol, according to the disclosed filing.

Amphenol has a couple of factories in China and is valued around $40 billion, while its rival Luxshare has a valuation of nearly 400 billion yuan ($61 billion).

Luxshare Precision on Dec. 22 was informed of notices issued by the United States International Trade Commission (USITC) regarding a Section 337 investigation. It has hired a team of U.S.-based lawyers to respond to the investigation and will undergo the 337 investigation process. The probe will have no substantial impact on current production or operations, said the company last Sunday.

"If Luxshare faces huge penalties that force it to stop the supply of key components for Apple, it will be a huge blow on Apple's entire ecology and a great loss to Apple and Luxshare Precision," Xiang Ligang, director-general of the Beijing-based Information Consumption Alliance, told local media Global Times. "Both companies will try to avoid such a situation."

Whether or not this is a valid case or could be seen as a Trump-era trade war attack against Chinese companies is still unknown, said analysts, since the filing took place prior to Biden's administration.

Tuesday, the Ministry of Industry and Information Technology responded that it's paying close attention to the probe and will safeguard the company's legitimate rights and interests.

"As the ministry in charge of regulating China's electronic and information industry, we resolutely protect intellectual property rights," said Huang Libin, a ministry official. "At the same time, we oppose the abuse of rights and the suppression of normal commercial competition."

In 2015, China launched the Made In China 2025 plan that seeks to engineer a shift for the country from being a low-end commodity manufacturer to becoming a high-end producer of goods. Beijing has been implementing various policy incentives to bolster the nation's electronics industry in a bid to become the heart of the Asia-Pacific supply chain.

Meanwhile, Chinese companies have been gearing up to enter the attractive iPhone assembly business amid a supply chain shift following the China-U.S. trade war, said analysts.

Previously best known for making Apple's AirPods series starting from 2017, Luxshare Precision acquired its first iPhone assembly plant last July from Wistron Corporation's assembly businesses.

Since then, Luxshare has been rumored to be eagerly making deeper inroads into Apple's supply chain. In the first three quarters of 2020, Luxshare saw net profits jump 62% to 4.68 billion yuan ($720 million), and revenue rose 57% to nearly 59.5 billion yuan ($9.19 billion).