Debt-ridden California-based electric vehicle (EV) startup Faraday Future is actively soliciting mainland China investment and manufacturing sources to revive its stalled business with some interest so far, and a possible backdoor U.S. listing also in the works, according to reports.

Faraday Future's new chief executive, former BMW executive Carsten Breitfeld said last October that the company "is working on a SPAC deal and will be able to announce something hopefully quite soon."

A special-purchase acquisition company (SPAC) creates pool funds to finance a merger deal. It is seen as a shortcut to the stock market and has been a particular favorite with EV start-ups.

In talks with Property Solutions Acquisition, Faraday Future looks to go public through a merger deal that will value the company at around $3 billion, according to Bloomberg. The deal can also raise $400 million in proceeds for the company.

Faraday Future is expected to submit the listing documents within two weeks and is likely to unveil information on the deal in China by then.

Faraday Future has been reportedly sought a new round of financing since last December.

China Evergrande Group and traditional vehicle-maker Zhejiang Geely Holding Group have expressed interest in making new investments in the EV startup. Geely will invest $30 million to $40 million in Faraday Future, according to local media 36Kr. Geely's announcement is expected to come next week.

Additionally, state-backed fund in Zhuhai, a city next to Hong Kong, plans to invest 2 billion yuan in the start-up, and "the two are in talks for cooperation details, and Faraday Future will land the business as a joint venture in Hengqin district in Zhuhai," sources told local media China Star Market.

The cooperation includes setting up the Faraday Future's first mainland China plant in Zhuhai, sina reported. Faraday Future refused to comment on the matter.

As of Dec. 14, FF Zhuhai, was established with $250 million in registered capital and is wholly owned by FF Hong Kong Holding. It was registered as a business covering sales of new energy vehicles, artificial intelligence software development and related activities, according to company information inquiry platform Qichacha.

Reuters reported this Monday the EV startup's initial China production facility will have an initial annual production capacity of more than 100,000 vehicles and it plans to set up a research center in a first-tier city.

Zhejiang Geely Holding Group is "in talks with Faraday Future to build the FF 91 as a contract manufacturer as well as to help FF improve the model's engineering design and offer intelligent auto technologies like autonomous driving," said sources.

Early this month, Geely forged a collaboration with search-engine giant Baidu Inc., for manufacturing electric vehicles mainly for the passenger vehicle market. Meanwhile, Geely also teamed up with Apple's main supplier Foxconn to contract manufacture electric, autonomous vehicles through a joint venture.

Contract manufacturing is becoming a major new revenue source for Geely, said analysts. However they see more underlying risks in collaborating with Faraday Future.

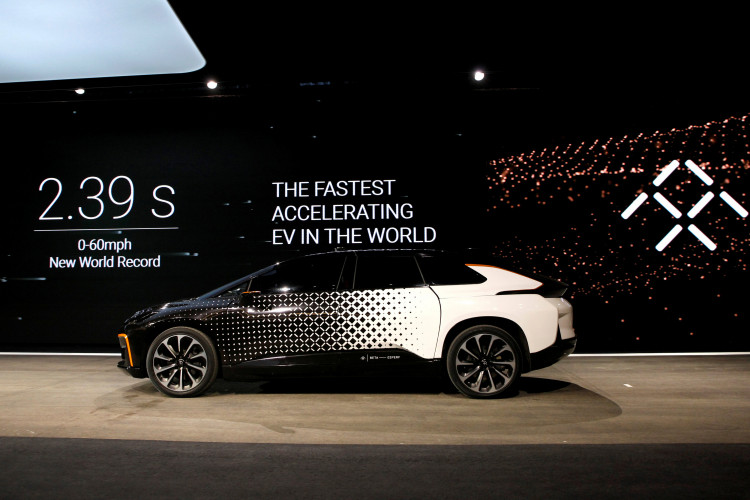

Founded in 2014, Faraday Future was co-founded and led by chief executive Jia Yueting. Its first production vehicle, all-electric FF 91, that the company initially promised to deliver to the market by the end of 2018, has been postponed several times. Jia was the former chairperson for Chinese technology group LeTV, which was involved in lawsuits owing to mounting debt problems since 2017.

Late in 2019, Jia filed for personal bankruptcy after Faraday Future accumulated more than $6 billion in debt. The company was focusing on a dual home market strategy in the U.S. and China and was preparing for an IPO, said the company at the time.