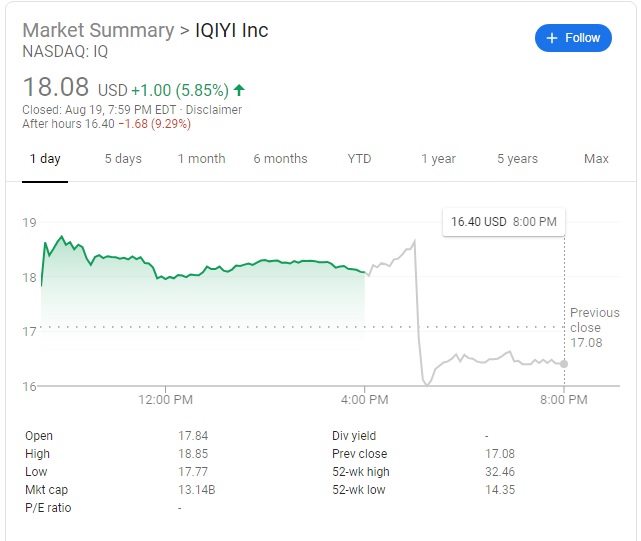

Update: iQiyi's stock is currently down by 9.29% in after-hours trading.

iQiyi Breaches 100-Million Subscriptions, But Stocks Drop 9%

One of China's biggest streaming companies, iQiyi's (NASDAQ: IQ) revenue soared 16 percent to $1.0 billion (RMB 7.1 billion) courtesy of a 51 percent climb in subscriptions. However, the company's stock plunged more than 11 percent right after announcing its annual earnings.

Popularly called the "Chinese Netflix", iQiyi Inc. breached the 100 million subscriber mark in its earnings posting late Monday. iQiyi Inc is a video streaming division of another Chinese giant, Baidu (NASDAQ: BIDU).

Based on analysts' estimates, iQIYI modeled for a decline of 44 cents a share on $1.0 billion revenue. Consensus estimates represent a 197.77 percent drop in iQiyi's earnings per share (EPS) figure. Total sales were be 9.37 percent on a year-on-year (YoY) basis.

The company also came short of Wall Street's projections for its second-quarter outlook, guiding for sales of 7.22 billion to 7.64 billion renminbi, while average analyst estimate was for 7.97 billion renminbi, based on a FactSet data.

Revenue from membership services were up 39 percent to $497.2 million (RMB 3.5 billion), while the company's content distribution sales fell 4.1 percent to $75.5 million (RMB 517.85 million) due to the deferment of certain content products.

In the past 52-week period, the company's stocks weakened 35.08 percent. Considering that these returns are mostly dismal, long-term stockholders are perhaps dismayed in the run-up to the earnings release. Market observers have adjusted their predictions lower for revenues and earnings per share in the last quarter.

On average, analysts have given iQIYI stock the "Sell" rating. The stability of this rating has diminished in the last quarter. In contrast, American Depositary Share for iQiyi settled with almost 6 percent rally at $18.09, but retreated lower than $16 during extended sessions following the earnings report.

In terms of online ads, iQiyi fell 15 percent year-on-year to $320.5 million (RMB 2.1 billion), dragged by the difficult macro-economic condition in China, the delay of certain content services and weaker-than-anticipated rebound of in-feed ads content.

Zacks' Consensus Estimate for sales is currently stamped at $1.05 billion, showing an improvement of 13.5 percent from iQiyi's recent quarter's figure.

Meanwhile, iQIYI's robust content lineup is a major catalyst. It released 'The Thunder' and 'Legend of White Snake' in the soon-to-be-posted quarter. Interestingly, The Thunder was well-received in China and AT&T's HBO bought the series license rights for Southeast Asia.

Moreover, iQiyi's collaboration with tech giants like Microsoft, Viacom, AIS, Ctrip, and China Unicom Global Ltd are seen to boost the company's online presence.