Nio Inc.'s stock jumped nearly 38 percent late Tuesday after the electric carmaker said they were partnering with Intel Corp-owned Mobileye to build self-driving vehicle solutions for the Chinese consumer market.

Under the contract, Nio will create and produce a Mobileye-designed self-driving car platform that builds on the Level 4 autonomous driving package of the Intel-owned company.

Self-driving car software is rated on a scale of 0 to 5, with tier 0 being the most primitive device and level 5 needing no human assistance.

"This self-driving system will be the first of its kind, focusing on consumer autonomy, engineered for standards of automotive qualification, quality, cost, and scale," Nio said in a statement.

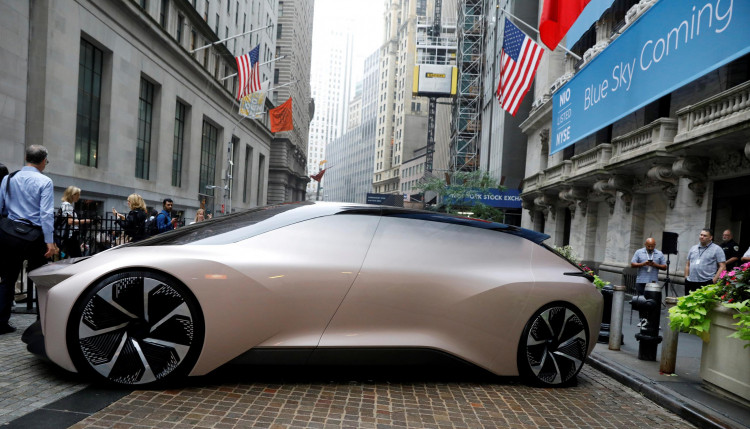

Nio, an electric vehicle (EV) maker popularly referred to as "Chinese Tesla", and based in Shanghai but headquartered in North America in North San Jose, said it "will mass-produce the Mobileye system as well as integrate the technology into its electric vehicles for consumer markets and driverless ride-hailing services for Mobileye."

The transaction is a bit of good news for Nio, which, following a series of declines, has seen its stock retreat nearly 80 percent from its 52-week peak in the last four quarters.

After a dismal financial output, the company said it trimmed down one-fifth of its workforce in September - at least its second major job cut for 2019. It's also only healing earlier this year from a battery recall.

For $15.3 billion in 2017, Santa Clara-based chipmaker Intel Corp. acquired Mobileye, an Israeli company that produces vision software for self-driving cars, representing its biggest takeover ever.

The companies are up against Palo Alto electric carmaker Tesla Inc., which has its own semi-autonomous Autopilot System, as well as smaller Intel competitor Nvidia Corp., which earlier this year signed a major deal with Volvo for automated commercial truck operating system.

Nio also published its new shipment figures on Monday, stating that in October it had 2,526 car orders, up 25 percent compared to the previous month.

The business is one of a range of Chinese carmakers who have founded Silicon Valley offices or research centers but market their automobiles to Chinese consumers exclusively.

The company said its latest results will be lifted by a state of the art Advanced Driver Assistance Systems (ADAS) market, while its plan to transition into data monetization and the Robo Taxi market will boost future results.

Over the past 12 months, Nio's stock has plummeted by 68 percent and Intel's shares have risen by 20 percent, while Dow Jones Industrial Average has risen by 0.11 percent.