After estimating that its sales growth will weaken this year, Alibaba Group Holding Ltd. came out quite sluggish, reflecting post-pandemic economic instability in the domestic scene and the possibility of China-US frictions to distort its business.

Alibaba's stock was down in Hong Kong late Monday as much as 4 percent, following a decline of nearly 6 percent in New York prior to the weekend break.

The e-commerce giant forecast sales growth of at least 27.5 percent to over 650 billion yuan ($91 billion), retreating from 35 percent earlier and moderately below Wall Street estimates. While the group reported a better-than -projected 22 percent climb of 114.3 billion yuan in total sales in the March quarter, that marked its slowest expansion rate on record.

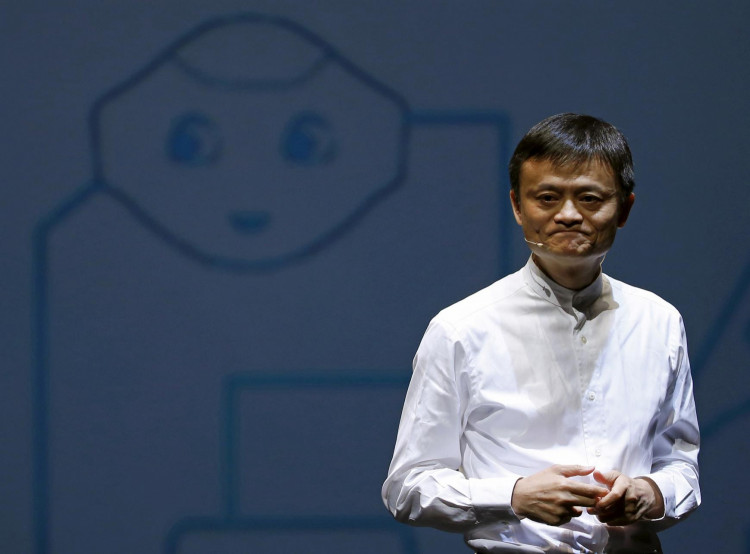

A weakening in the value of New York-traded stocks in China's e-commerce giant Alibaba Group on Friday took $1.5 billion off the company's main founder Jack Ma's estimated fortune. Alibaba declined nearly 6 percent to $199.70 after it disclosed net profit in the three months to March 31 dropped by 88 percent from a year ago to $447 million.

The company said that its year-on-year decline was mainly the result of a net decline in investment revenue, primarily reflecting losses in the market value of its investments in publicly-traded firms, compared to a net income posted in the same period last year.

ver the past year, Chinese tech giant Alibaba Group sold products worth US$1 trillion across its massive platforms, the company announced over quarterly results late last week. But a drop in profitability in the latest coronavirus crisis quarter sent its shares dipping, costing Jack Ma that much cash.

Cloud computing remains a bright spot for Alibaba, leading the sector in the APAC market, posting a rise in revenue of 62 percent compared to the previous financial year.

Online shopping, executives said, started to rebound from March. But the dreary outlook shows the world's second-largest economy has yet to shake off the virus in full, with consumers still hesitating to spend on big-ticket items.

The most successful Asian company is also battling the rise of rivals like ByteDance Ltd. and Pinduoduo Inc. And the Tmall operator is competing with Tencent Holdings Ltd. in all aspects of the market, from electronic media to payments and cloud computing to Internet dominance. JD.com Inc., China's No. 2 online retailer, forecasts earnings this quarter that are better than expected.

Meanwhile, billionaire Jack Ma's Ant Group earned around $2 billion in profits in the December period, boosted by its campaign to help China's lenders provide support to the nation's under-funded customers.