Reuters - Share prices on Asia indexes rose Wednesday after data showed China's economy was recovering - but a first U.S. presidential debate between President Donald Trump and Democrat candidate Joe Biden kept equities buyers at bay.

U.S. share futures price fell and the dollar, regarded as a safe-haven currency, was bought after the debate which offered few insights into the outcome of the U.S. election.

MSCI's broadest index of Asia-Pacific shares outside Japan rose 0.3% led by a 1.2% gain in Hong Kong. S&P 500 futures were up and down - and gave up gains as large as 0.7% to trade 0.5% lower for the day after U.S. President Donald Trump again cast doubt on whether he would accept the election's outcome. That also lifted the dollar a touch from overnight lows.

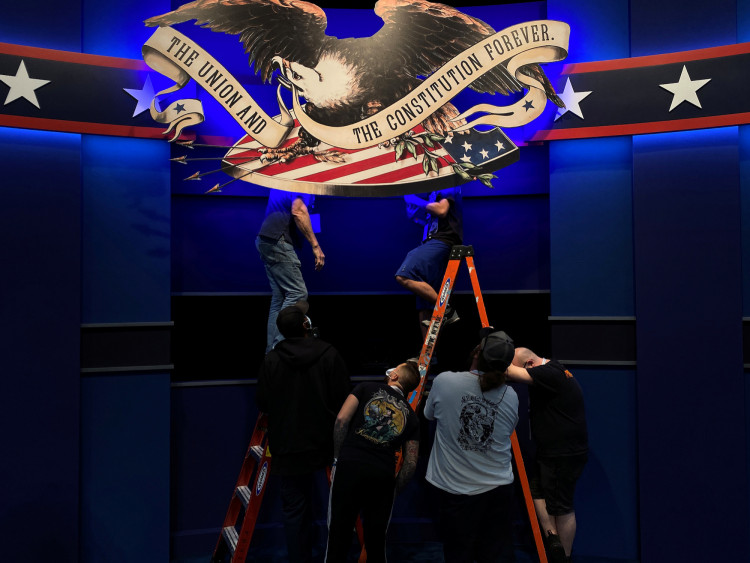

The first face-off between Trump and Biden was seen by some political analysts as Trump's best chance to upend a race where he has lagged in the polls. In a confrontational debate Biden pressed Trump over his handling of the coronavirus and Trump responded with personal attacks.

"Right now, it looks like an even split between Trump and Biden, so it is difficult for the markets to move," Sumitomo Mitsui Trust Bank market strategist Ayako Sera said. "What people are most concerned about is the fairness of the election and how it will be carried out...under normal circumstances. The positive economic data from China we've seen would support risk-off trades - but this time is different."

China's factory activity expanded at a faster pace in September, helped by a return to exports growth after several months of shrinking sales, bolstering a steady recovery for the economy as it rebounds from the coronavirus shock.

The official manufacturing purchasing manager's index rose to 51.5 in September from 51.0 in August. Analysts had expected it to pick up slightly to 51.2.

A separate private survey, also released Wednesday, painted a similar picture of the manufacturing sector gaining momentum with new export orders posting their biggest rise in three years.

Beyond Hong Kong, where gains were broad based, stocks in Shanghai rose 0.5%. Australia's ASX 200 slipped 1.6%.

World stocks have lost 3.7% in September, their worst monthly performance since March.

The U.S. presidential debate didn't move the needle in betting markets - which project a narrow Biden victory, and currency markets were broadly steady.

But as the election draws closer, investors are expecting a bumpy final lap of the campaign and are bracing for the possibility that the result is unclear on polling day.

Options trade shows that volatility is expected through October and November.

The euro pulled back from week-high $1.1755 after the debate to $1.1732. The risk-sensitive Australian dollar slipped to $0.7114.

During the debate Trump and Biden battled over Trump's leadership in the coronavirus pandemic, the economy and taxes.

Biden said in the closing stages of the debate that he would accept defeat if he lost at the ballot box, while Trump repeated his concerns that mail-in ballots could encourage fraud. "I don't think we were expecting anything else from Trump," said Chris Weston, head of research at Melbourne broker Pepperstone.

Elsewhere, oil prices fell to two-week lows touched overnight on rising concerns about fuel demand as the coronavirus pandemic worsens. Brent crude futures were last down 1.2% at $40.56 a barrel and U.S. crude futures were down by the same margin at $38.84 a barrel. Gold prices fell 0.4% to 1,890 an ounce.