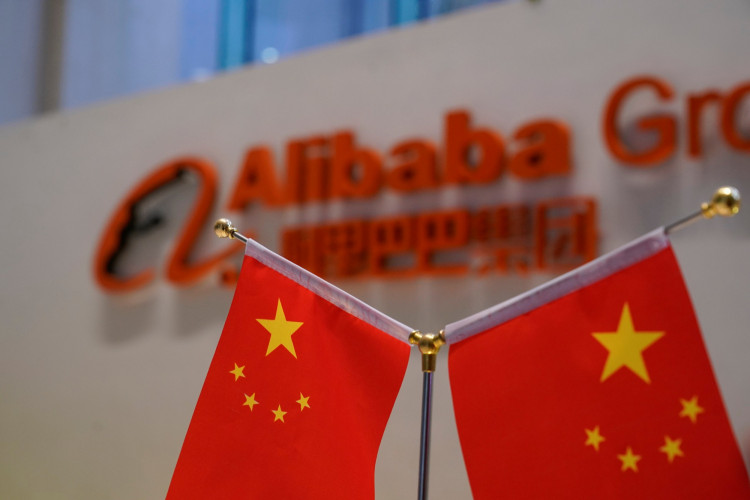

Chinese authorities said that they had summoned 11 tech giants, including Tencent, Alibaba, and TikTok owner ByteDance, for discussions on "deep fakes" and internet security, as regulators attempt to reel in the country's rogue digital sector.

The Cyberspace Administration of China (CAC) indicated on Thursday that the discussions centered on voice software that has yet to go through safety testing methods as well as the use of "deep fake" technologies. It also mentioned that businesses should inform the government of any intentions to add new functions that "have the ability to mobilize society."

Deepfakes use artificial intelligence to create hyper-realistic yet fake videos or audios in which a human appears to say or do what they did not.

According to the CAC, the summoning also includes Xiaomi, TikTok competitor Kuaishou, and music streaming service NetEase Cloud Music. The aim is to ensure compliance with rules, conduct safety inspections and implement "effective rectification measures" if potential dangers are discovered.

China issued regulations in 2019 prohibiting online video and audio services from using artificial intelligence (A.I.) and virtual reality technology to create "fake news."

The term "fake news" has evolved to symbolize something from a mistake to a joke or a malicious misinterpretation of facts.

Regulations highlight the risks of "deep fakes," which are videos that have been edited to look authentic but show incidents or statements that did not occur.

The CAC announcement comes just days after China barred access to the US invite-only audio app Clubhouse. The app briefly appeared on the mainland before vanishing, but it has since spawned a slew of copycats.

President Xi Jinping cautioned on Monday about the dangers associated with "platform" businesses, a concept that may extend to mobile and internet firms and called for increased regulation of the sector.

China has been hard on the country's fast-growing tech firms in recent months, with 12 businesses fined last week for allegedly breaking monopoly rules.

Last year, authorities thwarted a $34 billion initial public offering by Alibaba fintech subsidiary Ant Group. They summoned the company's billionaire founder, Jack Ma, and investigated Alibaba business practices deemed anti-competitive.