Intel Corp. is exploring a deal to acquire contract chipmaker GlobalFoundries Inc. for about $30 billion, The Wall Street Journal reported citing people with knowledge of the matter.

The U.S.-based GlobalFoundries is owned by Global Mubadala Investment, an investment unit of the Abu Dhabi government. The buyout talks appear to be between Global Mubadala and Intel, the Journal said.

Such a deal would benefit Intel's efforts to manufacture more chips for other technology companies.

However, there is no guarantee the deal would be reached. If it falls apart, GlobalFoundries could proceed with an initial public offering already planned for 2022, The Journal said.

GlobalFoundries, which accounts for 7% of all foundry business by revenue, is the No. 4 foundry in the world, according to TrendForce.

Intel declined to comment, while GlobalFoundries and Mubadala didn't immediately respond to requests for comment by Reuters.

A shortage in chips is affecting industries around the world. A deal between Intel and GlobalFoundries could help Intel boost production at a time demand is at its peak.

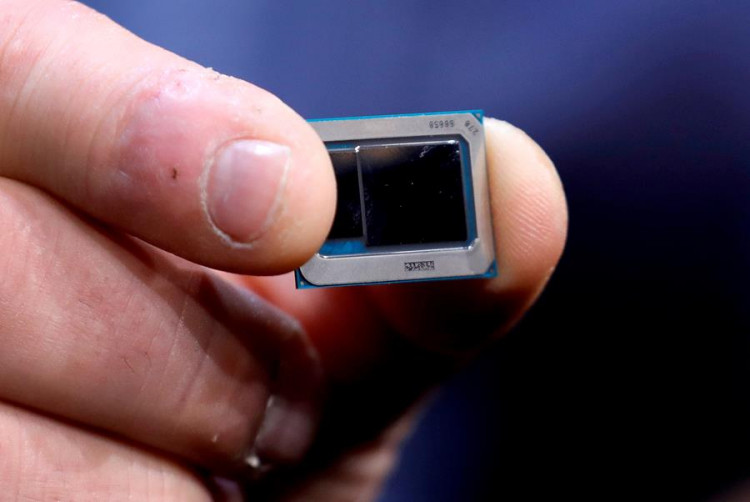

Intel, with a market value of about $225 billion, is one of the last companies in the chip industry that both designs and makes its own semiconductors.

The California-based company is planning to start making semiconductors for car manufacturers that have struggled to keep operations running because of severe shortages.

If the deal pushes through, it would bolster Intel's $20 billion plans to build its new contract production unit.

Called Intel Foundry Services, the new unit aims to operate as other contract chip makers, and will produce chips designed by other companies, The Journal reported.

Meanwhile, Pat Gelsinger, Intel's new chief executive, said more commitments locally and internationally are in the pipeline.

GlobalFoundries was once owned by Intel rival Advanced Micro Devices. AMD spun out GlobalFoundries in 2008, but the two companies maintain ties.