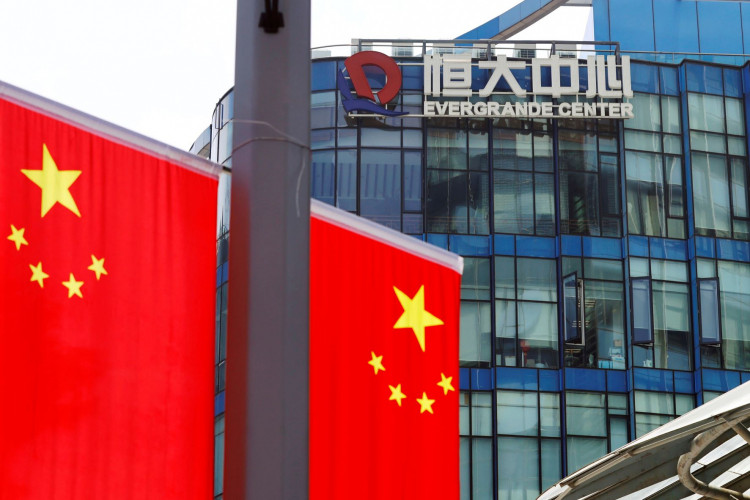

Signs indicate that a comprehensive investigation into the Evergrande Group is underway, signaling the potential end of this trillion-dollar business empire.

On a chilly autumn morning, Hui Ka Yan also known as Xu Jiayin, was abruptly awakened by a commotion at his residence. He was then taken away to "assist with an investigation." Despite the presence of several bodyguards and housekeepers, the process was swift and discreet, with few witnessing the high-profile figure's departure.

On the evening of September 28, China Evergrande (03333.HK) announced on the Hong Kong Stock Exchange that "the company has been informed by relevant authorities that its executive director and chairman, Hui Ka Yan, has been taken into custody for alleged illegal activities. The company's shares will be suspended from trading on the exchange from 9 a.m. on September 28, 2023, until further notice."

Insiders revealed that other key figures from Evergrande, including Hui Ka Yan's second son, Peter Xu (Xu Tenghe), who once led Evergrande Wealth, as well as former CFO Pan Darong and former chairmen of Evergrande Real Estate Group and Evergrande Property Group, Zhen Lita, were also taken in around the same time.

Previously, other executives, such as former Real Estate Group chairman Ke Peng and Evergrande Wealth's legal representative and executive director Du Liang, were already under investigation.

Several Key Figures Investigated

Rumors of Hui Ka Yan's detainment had been circulating within Evergrande for some time. "We're not sure if he's being investigated or just assisting with one," said an insider.

However, it's widely believed that Hui Ka Yan's second son, Peter Xu, was taken in alongside him. Calls to Peter Xu's phone went unanswered. Known internally as Peter, he has kept a low public profile. His last notable appearance was in December 2021 when foreign media reported he sold a mansion on Los Angeles' Sunset Boulevard for a discounted $12.5 million. Within Evergrande, Peter Xu initially oversaw the Pearl River Delta branch before transitioning to manage Evergrande Wealth.

Other significant figures from Evergrande recently taken for investigation include Pan Darong and Zhen Lita. Pan Darong, born in 1973, joined China Evergrande Group in 2006 and held various financial management positions. Zhen Lita, a graduate of Tongji University in Shanghai, joined the Evergrande Group in 2009 and held various leadership roles.

Restructuring Efforts Stalled

Hui Ka Yan's detainment directly impacts the debt restructuring process he was actively promoting. According to the original plan, Evergrande was to hold crucial creditor meetings on September 25 and 26 to vote on the proposed debt restructuring plan and submit the results to the relevant courts for approval.

However, on the night of September 22, Evergrande suddenly announced the postponement of these meetings, without specifying a new date.

To avoid bankruptcy, Evergrande initiated an overseas debt restructuring process early on. The restructuring plan was divided based on the issuing entity. The idea was to address the total overseas debt of approximately $19.149 billion through a combination of issuing new bonds and debt-to-equity swaps.

However, the official creditor meetings were repeatedly postponed. The meetings were initially scheduled for August 23 but were delayed multiple times.

Hui Ka Yan was keen to expedite the debt restructuring and resume stock trading. However, all progress stalled after his detainment.

Industry insiders have become pessimistic about Evergrande's debt restructuring. IPG's Chief Economist for China, Bai Wenxi, told Business Times that it's still uncertain whether Evergrande will eventually go bankrupt. The decision to enter bankruptcy proceedings isn't just a business or legal issue; it also involves social issues like ensuring housing deliveries. Without a concrete solution to these housing issues, it's unrealistic for Evergrande to officially declare bankruptcy, though its outlook is indeed grim.

"Currently, all parties may need more time and effort to find solutions, including renegotiating debt restructuring terms, seeking new investors, and selling assets. If the current predicament cannot be effectively resolved, the likelihood of bankruptcy will increase," Bai Wenxi stated.