The New York-listed investment arm of New Frontier Group, New Frontier Corp, has signed an agreement to acquire China's United Family Healthcare in a $1.44 billion deal.

The purchase of the Chinese private hospital operator is aimed at establishing one of the largest publicly traded privately-operated health care firms in China.

According to a press release regarding the deal, New Frontier will be acquiring the controlling stake of the privately-held hospital operator from private equity companies Shanghai Fosun Pharmaceutical Group and TGP.

New Frontier will be funding the acquisition through the capital it had gained from its recent initial public offering (IPO) and from funds it will be acquiring from different loan facilities.

Following news of the planned acquisition, New Frontier's share prices had jumped by 0.6 percent to $10.24 in New York. The announcement of the agreement was formally revealed early Tuesday morning.

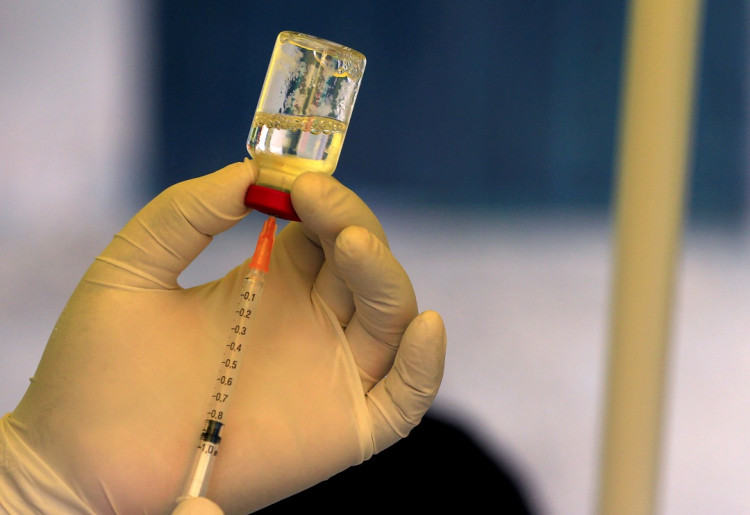

New Frontier is banking on China's aging demographics and the high demand for private hospitals and other healthcare-related services. With growing income and the availability of health insurance in China, the demand for an alternative to crowded state-owned hospitals continues to rise.

According to New Frontier chairman, Antony Leung, the company aims to capitalize on this trend by building and growing its portfolio of health care services and platforms in the region.

Data from the National Health Commission of China has revealed that private hospital revenues in the country have grown by an annual compound rate of 25 percent from 2013 to 2017. The market continues to be flooded with new players who want to capitalize on China's growing demand.

New Frontier Group aims to establish new players in the market with a focus on integrated health care services through a robust platform. The company is also planning to form new alliances within the sector to help it achieve its goals.

United Family Healthcare is one of the biggest private hospital operators in China. The company, which was established in 1997, owns and operates nine major hospitals in first and second-tier Chinese cities. The company has a total of 700 licensed beds catering to Chinese customers.

Analysts predict that the hospital will generate around $363.3 million in revenues this year. Due to its rapid expansion, the firm is also expected to have an 18 percent compound annual revenue growth rate and a 50 percent annual profit growth rate in the next five years. The rapid growth is attributed to the company's organic expansion in the region, driven mainly by demand.