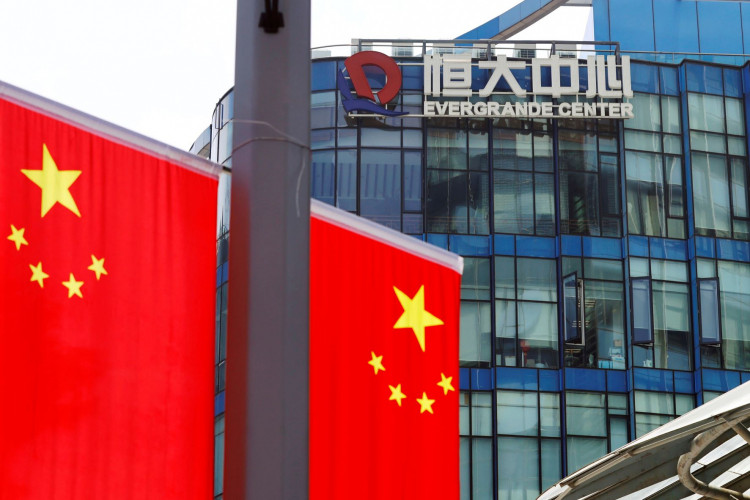

To pay interest payment that will be due this week, embattled Chinese real estate developer China Evergrande is selling its stake in a state-owned asset management company. The company said it plans to offload its stake in Shengjing Bank worth an estimated $1.5 billion.

Evergrande, which is struggling due to its exiting debts of more than $300 billion, has been divesting some of its major assets to keep up with payments. A bond interest payment of around $47.5 million is due today, Wednesday.

The company divulged the divestment in a filing with the Hong Kong Stock Exchange Wednesday morning. Evergrande said it had reached an agreement with Shenyang Shengjing Finance Investment Group, which will be buying its 1.75 billion shares in Shengjing Bank.

The filing said Shenyang Shengjing Finance agreed to pay 5.70 yuan per share. Evergrande's stake in the bank represents about 19.93% of its issued share capital. Evergrande previously divested 1 billion yuan worth of shares in the bank.

Evergrande said that its liquidity problems have affected its creditors and suppliers, including Shenjiang Bank. The company said that the deal should help "stabilize the operations" of the bank now that its shares will be owned by Shenyang Shengjing Finance.

The developer first disclosed its liquidity problems in September last year, when it issued two warnings to investors indicating that some of its debts may default. The disclosure raised fears over the future of the company, which has become the world's most indebted real estate firm.

Last week, Evergrande missed a key $83.5 million coupon payment on an offshore $2 billion 5-year bond. The company can still prevent the debt from defaulting if it manages to pay it off within 30 days of the due date.

Global markets are keeping a close eye on the company's actions and if it manages to make interest payments, including the $47.5 million payment on a $1 billion dollar-denominated bond that will mature in March 2024. Evergrande also has interest payments due in October, November, and December.

Despite its liquidity problems, some analysts said that now is actually a good time to invest in Chinese stocks. After most had exited Evergrande bonds and as its stock tumbles, yields on its multi-year bonds have increased.