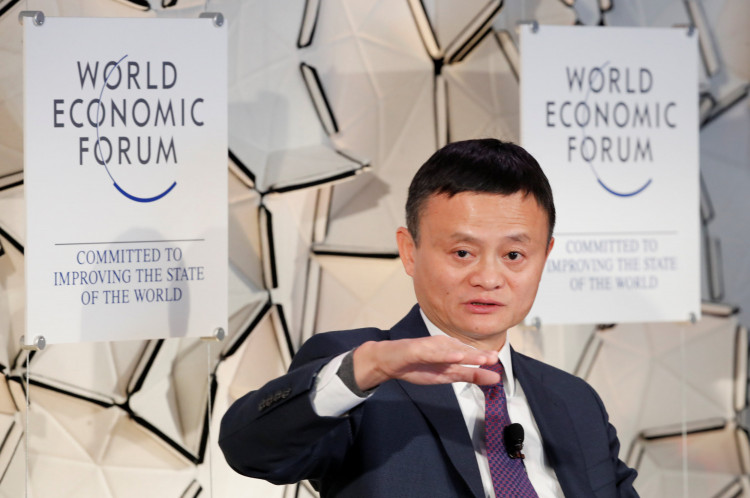

Ride-hailing newbie Hello TransTech is opening in full throttle as it was confirmed that Jack Ma's financial service company, Ant Financial, is among the provider's main investors.

Following the crackdown on China's top ride-hail company, Didi, a shortage of cheap rides spread across the country. With the entry of Hello's carpooling service, it is expected that passengers will jumpstart the hitching industry once more.

According to Tech Crunch, Ant Financial previously assisted Hello when it didn't have carpooling services and it was still called Hellobike. Ma's financial service firm partnered with Hellobike in a program that allows AliPay users to access the hitching service without the need to download the Hellobike app.

In a press conference on Friday, Hello said that its carpooling segment offers over 2 million drivers in 300 Chinese cities. So far, the service has recorded 7 million rides. Growth rates are going strong, the company said.

Hello's carpooling service is getting a good push from Alibaba and AliPay users as the provider sets its eyes on offering safe rides to passengers through the use of facial recognition and real-name verification features.

Aside from the cloud-based features that Alibaba gifted to Hello, the carpooling company is also in constant communication with security departments in China to ensure that drivers go through a background check before they are allowed to partner with the firm.

Compared to Didi's 66 million unique devices on its app, Hello is far behind with only 6.3 million. However, security and safety issues have contributed to Didi's decline in domination following the murder of two female passengers during a ride with Chuxing drivers.

Financial analysts suggested that Alibaba and Ant Financial's latest move is part of the Chinese tech giant's efforts in expanding its projects and investments. While Ma's company is supporting Hello, it is worth noting that Alibaba is a minority stakeholder in Didi Chuxing.

Meanwhile, spectators are eager to know how far Ant Financial will go as the company founded by Ma recently made a huge step in its international activities.

Bloomberg reported that the Chinese financial services giant has purchased WorldFirst, the London-based payments company that marks the firm's first big move in the eurozone. The acquisition is expected to give Ant Financial more opportunities to serve smaller businesses in other countries outside of China.

In a memo released to its clients, WorldFirst CEO Jonathan Quinn said, "The products and services of Alipay and WorldFirst are highly complementary. All your current customer and account information will also remain unchanged."