Japan Enterprises Strong On China Business

Japan companies are bullish on their investments in China with 43.2% of its companies in China indicating they might expand while 50.6% plans to maintain the status quo, according to a 2020 White Paper on the China economy and Japan enterprises.

Japan External Trade Organization, a Japan trade and investment promotion agency, published the report Wednesday to explore insights into business development.

It was based on a survey JETRO conducted among 8,678 legal representative members in 678 Japan companies in China.

Only 9.2% of the companies considered or implemented plans to move factories out of China. The main reason for departure was rising salaries in China, said Takeo Donoue, director-general of JETRO.

With optimistic projections for business potential, Donoue called for China's further opening to foreign business by adopting international standards and relaxing restrictions in manufacturing and services. He hopes to see a fair competitive business environment in intellectual protection and investment.

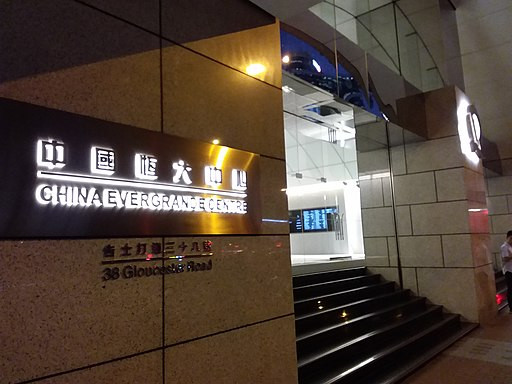

Real Estate Giant Eager To Clear Debt

China real estate company Evergrande Group announced Thursday the early payment of 10.6 billion yuan ($1.565 billion) in senior loans before Oct. 23 - the largest advance payment ever for a Hong Kong-listed company.

This move came in response to the China government's rolling out of new measures to clamp down on excessive leverage and flow of capital into the country's real estate market.

In August, the People's Bank of China and the Ministry of Housing and Urban-Rural Development laid out a proposal which would divide real estate enterprises into four tiers, divided by three "red lines" based on their debt-to-asset ratios excluding advance revenue on sales.

As of August, Evergrande made 450.6 billion yuan. It expects to reach its 650 billion yuan sales goal by the end of October and this week, the company announced it was raising HK$4 billion ($516 million) through the sale of 176.6 million shares to a new round of investors.

Burger King Denies Sale Of China Unit

In a response to Bloomberg News alleging Burger King was selling half its China unit, the company said it didn't have any equity sale process underway. It, however, didn't deny that some investors were interested in acquiring the business. Meanwhile, talks are at initial stage, The Paper reported.

TAB Food Investments, the largest international franchisee of Restaurant Brands International Inc., is working with an adviser to assess interest among potential buyers, including private equity companies. The sale of a 50% stake in the Burger King China unit would be valued at more than $1.2 billion, Bloomberg reported Thursday quoting unidentified people with knowledge of the matter.

To date, Burger King has nearly 1,300 outlets across China since entering the market in 2005. TAB Food Investments is the biggest franchise for Burger King worldwide. Its China business started in 2012 and is present in more than 150 cities.